How to calculate customer churn rate?

Customer churn rate – should be simple enough, right? The higher the churn rate, the less business your customers are doing with you. Whether they go to the competition or decide to buy less, the result is the same. Your churn rate’s up… and business is down!

But is it really that simple? Judging by the board-level conversations that are taking place, no it isn’t. And the pandemic has only made the problem more palpable. According to the Gartner 2020 Technology Marketing Benchmarks Survey*, 50% of C-suite execs in companies with more than $100 million in revenue are very concerned about customer churn caused by the economic disruption related to Covid-19.

Sounds scary, doesn’t it? Read on to learn how you can stop customer churn from bleeding your business dry.

What is customer churn rate?

Customer churn rate is the rate at which customers stop doing business or cancel a subscription with a company, over a given period. You might also know it as attrition rate.

Churn can be reflected through diminished usage of a product or service, or failure to buy again or renew. Depending on the context, a company’s customer churn rate can be calculated monthly, quarterly, or annually.

It’s worth noting at this point that customer churn is a natural part of the customer lifecycle, so targeting a churn rate of 0% is simply not realistic… Customers might decide to switch to a competitor, or that they can no longer use or afford your product or service. Plenty of reasons for them to go, but also plenty of ways for you to try and retain them.

Now that you know what the customer churn rate is, how do you work it out and how can you shrink it?

Churn rate formula

Example: That means if you want to calculate your annual churn rate, you’d take the number of customers lost over the last year, say 2,000, and divide it by the number of customers you had at the start, say 50,000, and then multiply by 100 to get the percentage. So, 2,000 / 50,000 = 0.04 (x100). So, your churn rate is 4%.

Monthly & annual churn rate

Just like recurring revenue, churn rate is usually calculated on a monthly or annual basis. Easy enough to adapt the metric by measuring the number of total and lost customers over the period you’re interested in.

What often happens is that companies work out their annual churn rate and divide that by 12. So, in our previous example, if your annual churn is 4%, your average monthly churn would be about 0.33%. That means you’re set to lose 4 customers for every 100 customers you had at the start.

What you must be careful about is doing this calculation in reverse. If you take the total and lost count of customers in one month, and multiply this by 12, then technically you have your annual churn rate. But you’re much more exposed to granular discrepancies then. You might have a particularly good month, with low churn (for instance a month where you have lower annual re-subscriptions), so your annual rate would be artificially inflated. And vice versa for a high-churn month, maybe at the end of the year. Most CRM platforms can calculate churn rates automatically but bear in mind it needs reflect actual attrition. Or you might be making decisions based on a false assumption.

How to use churn rate findings

You’ve now worked out your customer churn rate… What now? The lower, the better, so how do you get your churn rate down and keep customers longer?

- Get to the why

So, you’re losing customers. Join the queue. It’s a normal part of business. But that doesn’t mean you shouldn’t dig deeper. You probably could have retained some of these customers, those who didn’t move, die, or have a similarly sensible reason for leaving your brand. You might have been able to save those customers who chose to leave you for the competition or because they decided they didn’t need you anymore.

Make sure you include a loss feedback mechanism as part of your Voice of the Customer program. Even if it’s too late to save these customers who are on their way out, the insights you’ll get will likely help you save others from leaving too. Remember to make it timely and easy for them to share their feedback. After all, they’re no longer as invested in your brand as they were. In rare cases, if you’re honest and open, you might be able to turn the situation around and get some of your lost customers to come back. Showing you really care about why they left, and that you’re genuinely sorry about their issues – that might just do it! - Build a rapport

You’re a lot less likely to lose customers if you make them feel part of your community. Engaged customers don’t usually churn, so engage more. This starts with a solid onboarding strategy for new customers, making sure they have everything they need to make the best use of your product or service. After onboarding, map key stages along the customer journey and touch base with them then. They should know you’re there for them at every step. And don’t forget to go the extra mile occasionally and invest in some wow moments along the way.

The way you engage is also important. If it’s just a tick on a checklist, they’ll know. So, use the right tone of voice to show you care. Be generous! Share useful content and respond to queries quickly and efficiently. Bust any barrier your customers might encounter, preferably before they hit them. If appropriate, show your fun side. It’s a lot harder to do all this, than the bare minimum. But if you get it right, your customers will pay you back in spades and stick with you… even if you get it wrong sometimes. - Listen to them

It’s great to engage, but listening is vital too. Install listening posts at key interactions to make sure you catch angry or annoyed customers. Find ways to spot detractors early and convert them before they churn. Pick the right mix of channels and methods to get this feedback: in some cases, a single question via mobile is perfect, in others, an invitation to join a focus group and be part of the innovative journey of the brand. And don’t forget to keep an eye on those pesky reviews online.

Analytics comes in handy here. As mentioned, some churn can’t be avoided, and maybe shouldn’t be. You could spend $50K stopping 2% of any customer churning, or 1% of your higher-spend customers. But which one is worth more? Only proper segmentation and analysis will tell you the answer. But a blanket churn strategy is rarely the way to go. Same goes for using analytics to spot moments that matter. For instance, you might find out that churn rates are twice as high if customers don’t log in every month. In this case, ask them for feedback after 20 days to see if they need any help. Chances are, they do and haven’t had a chance to ask yet. - Engage your staff

If you don’t treat your staff well, how can you expect them to treat your customers well? And yet we see this vicious circle repeat itself, time and time again. One bad interaction with a disengaged employee can often be enough to push a customer out of the door. Engagement is one thing, training is another. What your staff knows – how well they can respond to queries and issues – makes a huge difference to customers’ loyalty to your brand.

And don’t forget, your staff can’t be engaged if they’re not empowered. Make sure employees receive insights about customer feedback in a timely and relevant manner. Display a dashboard in the contact center with key metrics and token verbatims. Send a quarterly report to a VP Sales showing the customer churn rate and top 5 reasons for attrition. - Be accessible

Customers expect access to brands, now more than ever. They expect an easy way to talk to your staff about their issues, in the channel they prefer. That means opening your brand to your customers instead of controlling access. And that’s not easy. Especially whilst trying to deliver a consistent experience whichever “way in” they choose.

But technology’s on your side. Chat functions are now easier and more intuitive, enabling agents to carry out multiple conversations at the same time. And if you can zoom in on your customers’ key issues, the ones that keep coming back, you can put them on an FAQs page online and let customers find the answer themselves. Although if these issues do return, maybe a more permanent fix or process change might help everyone in the long term.

“When the customer comes first, the customer will last.” – Robert Half

Why is it important to calculate customer churn?

So, what’s the point of calculating customer churn rate anyway? All businesses lose customers… isn’t it better to focus on customer acquisition? Bear in mind that increasing customer retention rates by 5% can increase profits by 25% to 95% (1). And the fact that it’s 6 to 7 times more expensive to acquire a new customer than it is to retain an existing customer. Surely that’s enough to convince you to pay attention to your churn rate.

Despite all the proof points that show why you should pay attention to your churn rate, here’s a stat that makes little sense: around 44% of businesses focus on customer acquisition, while only 18% focus on retaining existing customers (2). Yet it’s clear that what you do to reduce churn impacts directly and positively on your revenues. Even better it maximizes your acquisition efforts as it means you won’t keep feeding a bottomless funnel.

So why do companies juggle so much between acquisition and retention? The truth is, they both matter. What you need is balance. If you focus too much on acquisition, you risk losing too many customers. And if you focus too much on churn, you risk not filling up the funnel enough. Because churn is inevitable, but minimizing it is essential. A good indicator to focus on for balance is Customer Lifetime Value (CLV). It helps you keep an eye on attracting higher-value customers, not wasting time on retaining low-value customers at any cost. CLV gives you a balanced view of where you need to put your money for maximum ROI.

Clearly customer churn rate needs to be at the core of your strategy, as retaining your best customers helps your bottom line, and stops your competitors getting their hands on them. But keep in mind you need to balance this KPI with others, like customer acquisition, CLV, and overall profitability, so you don’t lose sight of the bigger picture.

What is a good churn rate?

Ha, you know the answer to that one isn’t going to be easy. Different industries show different churn rates, and sometimes they’re even measured in slightly different ways. For instance, revenue churn rate is sometimes calculated instead of customer churn (revenue lost divided by total revenue at the start of the period).

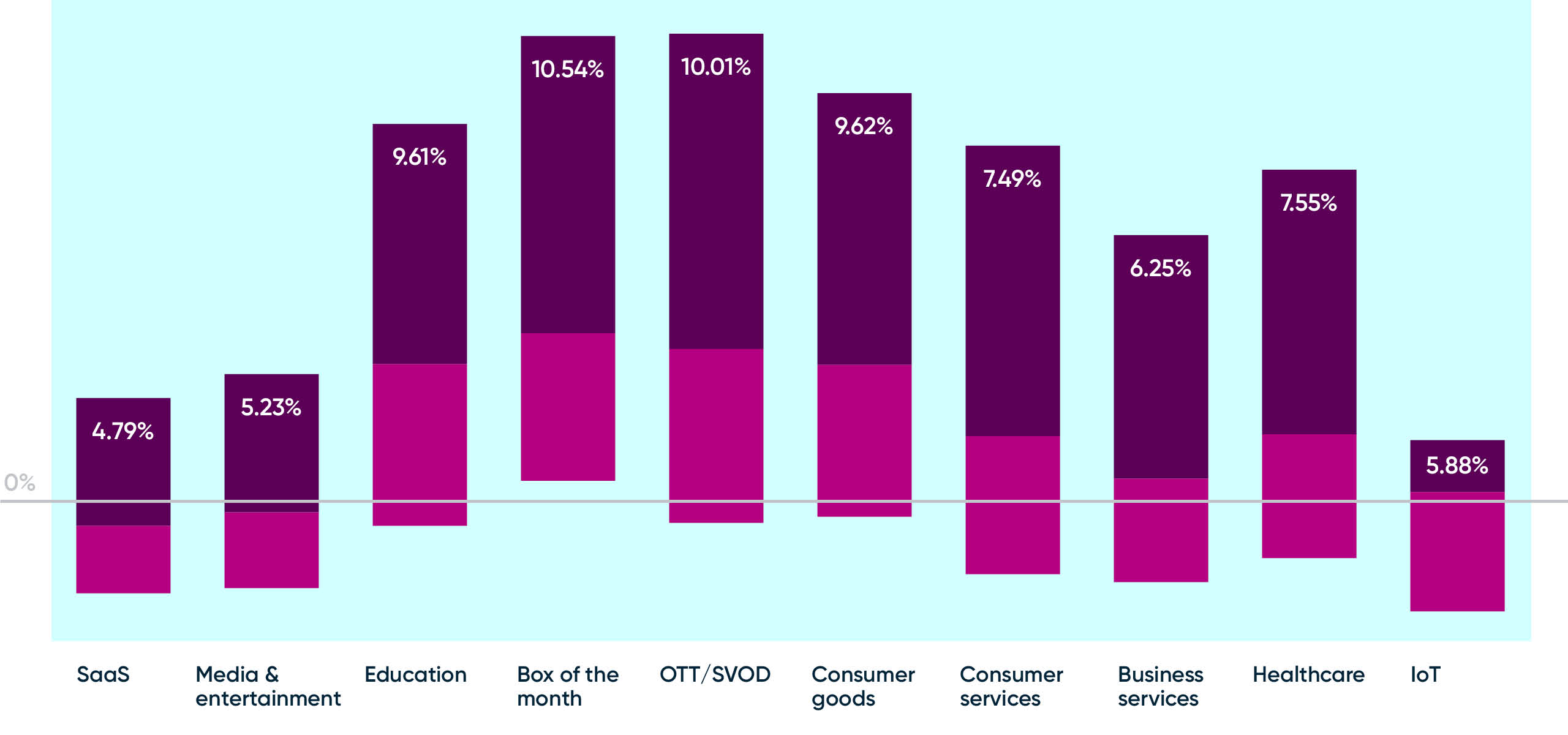

What matters isn’t the number itself, but where you’re positioned within your own competitive set. The charts below (4 and 5) show average monthly churn rates by industry type.

Customer Churn Rates Benchmarks (4)

Generally average monthly churn rates fall around 5% for B2B and 7.05% for B2C. This reflects the fact that B2B customer relationships tend to be more complex, and harder to switch away from.

What’s your ideal churn rate? If you look at the average rate for your industry, you’ll want to be below that. Easy, right? Well, if you become a CX leader in your field and follow our guidelines above, you can be at the top of your game, and the bottom of the churn tables.

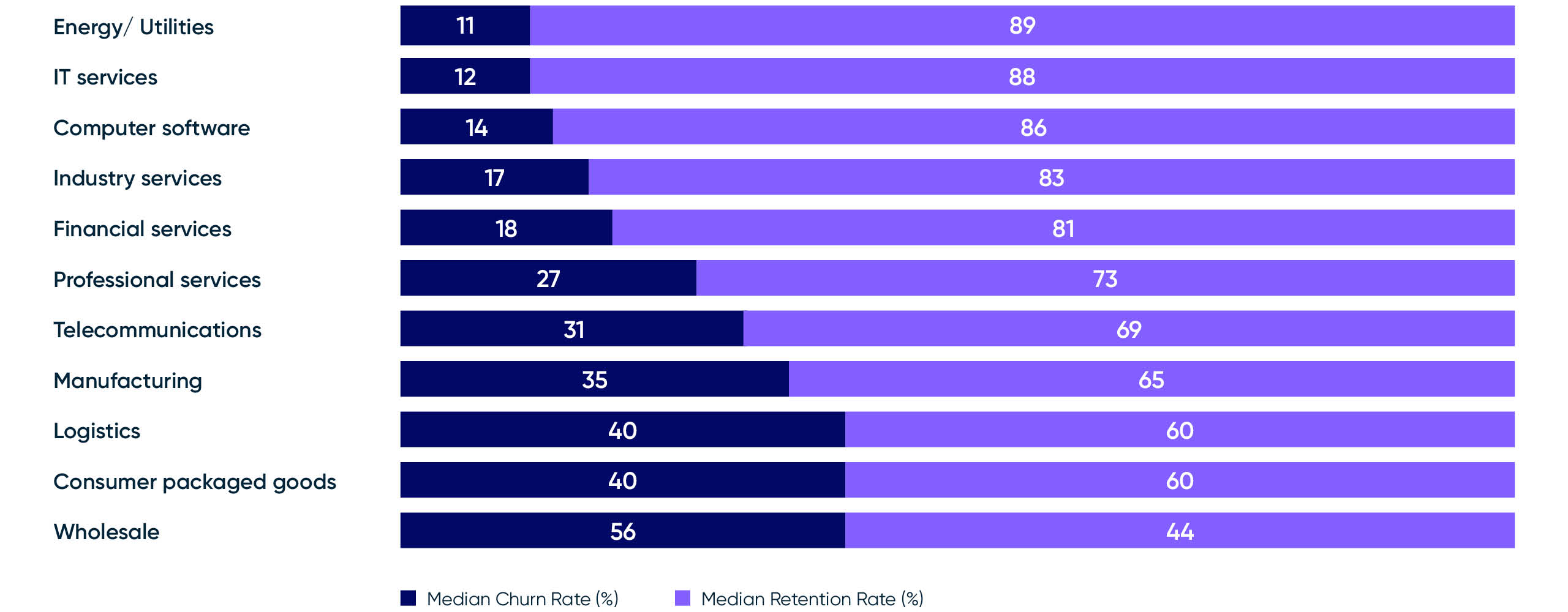

Median Customer Churn Rates by Industry – 2022 (5)

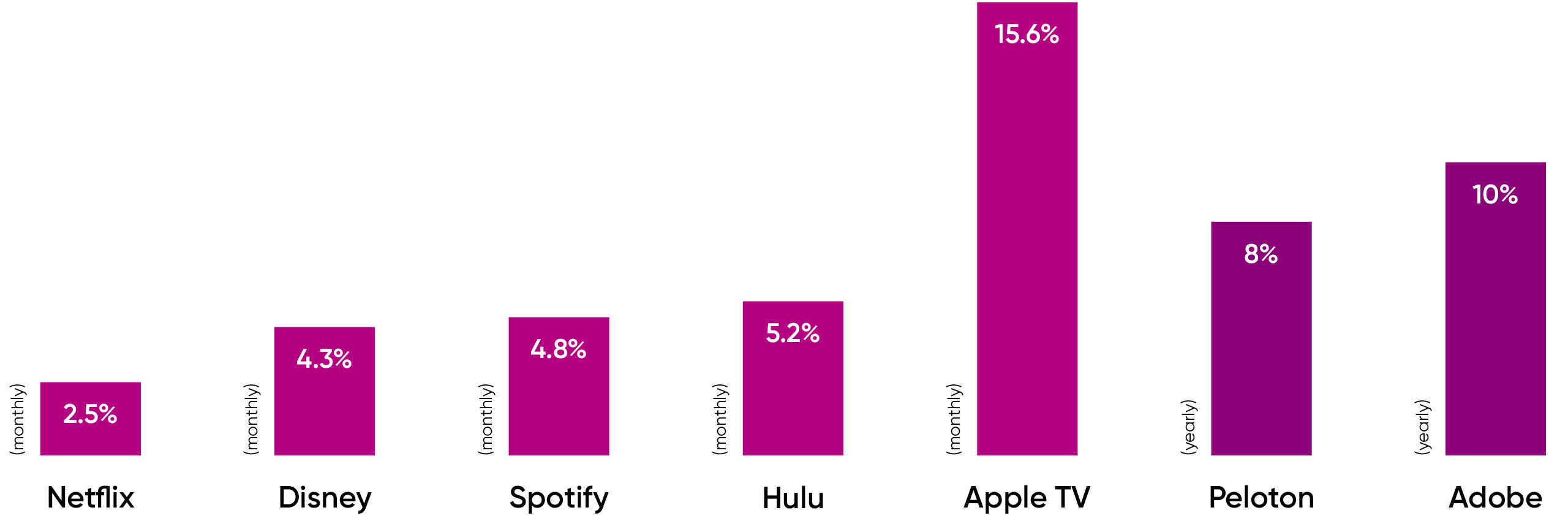

Churn rate examples

What about leaders in their industry? What’s their churn rate? Well, here are some examples (6) from the streaming/SaaS industry to give you an idea:

How can Forsta help?

As we saw, customer churn and customer experience are tightly related. The customer experience you provide, the lower the churn. That’s where Forsta comes in. We keep you close to your customers at every step of the journey. We help you understand them better. We let you into their world so you can see through their eyes.

With Forsta, you can see your customers as people, so you can serve them better. Our technology lets you put an ear to the ground at key moments for your customers, so they can share what they think and feel with you through their favorite channels. And we give it all meaning by turning data in black and white into stories in color.

So, you can decide what needs to change and make it happen.

So, you can fix things.

So that you can stop customers from leaving.

Conclusion

Customer churn can make or break your brand. Simple as that. You might have outstanding new business revenues and cost control your competitors can only dream of, but if you can’t keep your churn contained, what’s the point? You’re basically working hard to fill a bottomless barrel.

So put in place robust churn-stopping strategies in place early. Make sure you plug any leaks by constantly monitoring the health of your customer relationships and acting early to resolve issues. You won’t be able to stop all your customers from leaving, but if you do a better job than your competitors, no doubt you’ll be losing less of yours and pinching many of theirs.

Lower customer churn rate leads = higher customer lifetime value = higher profits = healthier bottom line.

Definitely worth the effort.

Related stories

The future of CX is human: An agile playbook for experience leaders

The future of CX is human: An agile playbook for experience leaders The future of CX is human: An agile playbook for experience leaders Human-centered. Insight-driven. Built for what’s next in CX. Customer experience is stuck. Overrun by scores, trapped in silos, and too slow to act, most programs are missing what matters most: the […]

Fixing the CX disconnect: What customers really want in 2025

Fixing the CX disconnect: What customers really want in 2025 Webinar synopsis: Personalization is expected. AI is everywhere. Loyalty is fragile. And trust? It’s make-or-break. In this exclusive webinar, we unveil the results of Forsta and Watermelon’s newest study: a dual-market, multi-generational snapshot of what consumers really want from the brands they bank with and […]

Picture this: The future of visualizations

Picture this: The future of visualizations Webinar synopsis: In a world drowning in data, only the clearest stories rise to the surface. This webinar brings together industry expert Mike Stevens and a panel of seasoned Forsta clients to uncover how research visualizations don’t just explain the past—they shape the future. Together, we’ll explore where visual […]

Learn more about our industry leading platform

FORSTA NEWSLETTER

Get industry insights that matter,

delivered direct to your inbox

We collect this information to send you free content, offers, and product updates. Visit our recently updated privacy policy for details on how we protect and manage your submitted data.